Published in March each year, The Wealth Report from Douglas Elliman | Knight Frank provides an annual assessment of global prime property and investment trends. This monthly update provides an opportunity to share timely insight on current themes. In this edition we introduce The WealthReport: Outlook 2023, a short research paper which examines the key investment risks and opportunities wealthy investors are focusing on for the year ahead. There are some strong talking points here which will be useful in your client conversations. As always if you have any observations or questions please contact me.

New Year, New Opportunities

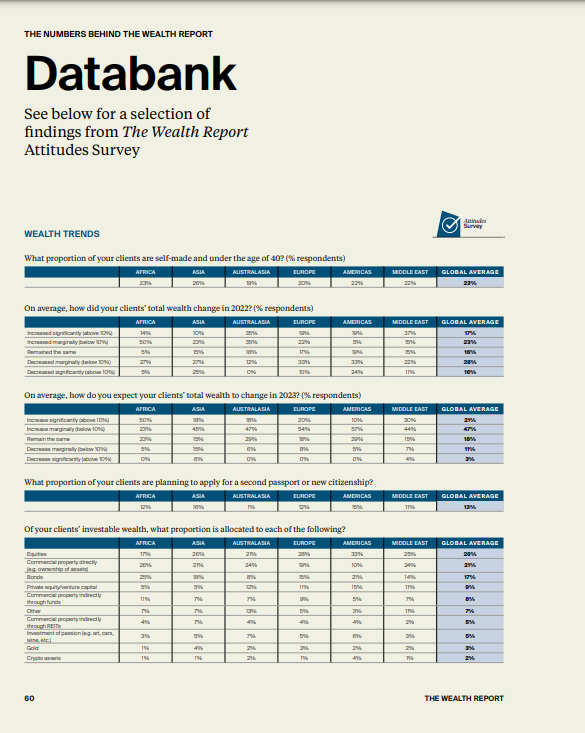

Our annual wealth and investment survey is released today, and despite negative trends spanning economics and geopolitics, our survey panel is feeling optimistic about 2023.

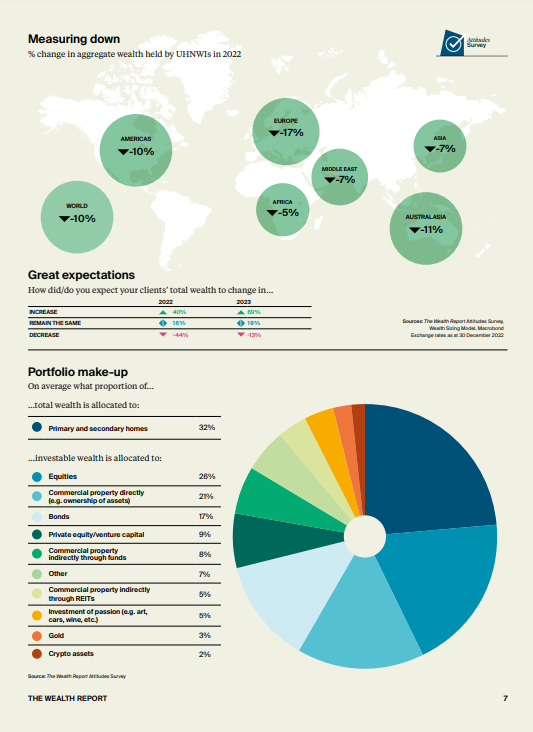

That comes on the back of a tough twelve months when only 40% of our panel managed to grow their wealth in 2022, but almost 70% are expect to do so during the year ahead. Real estate, currency trades, market timing and, for the first time in more than a decade, the return on cash were all noted by our panel.

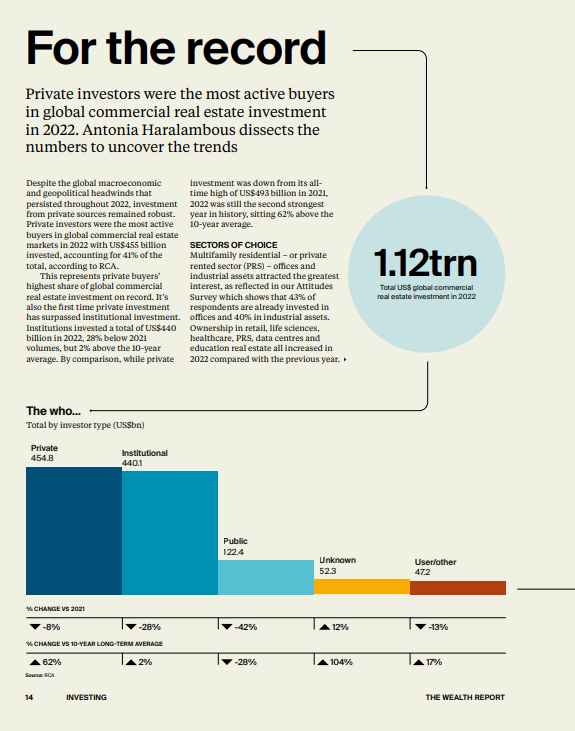

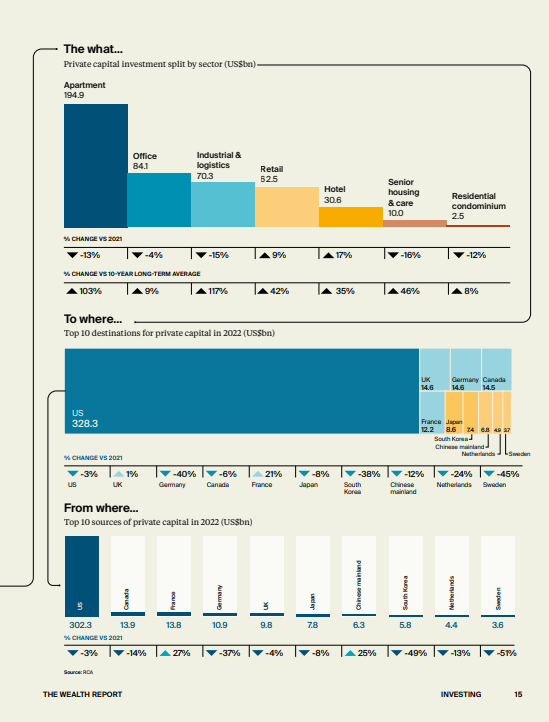

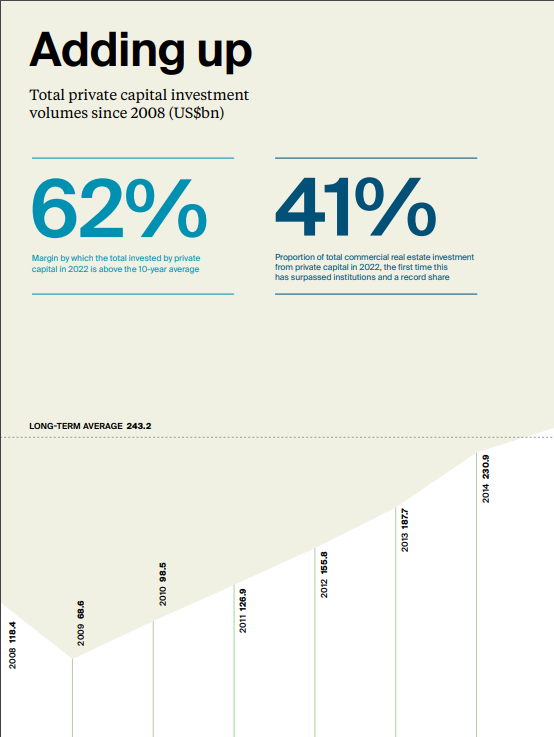

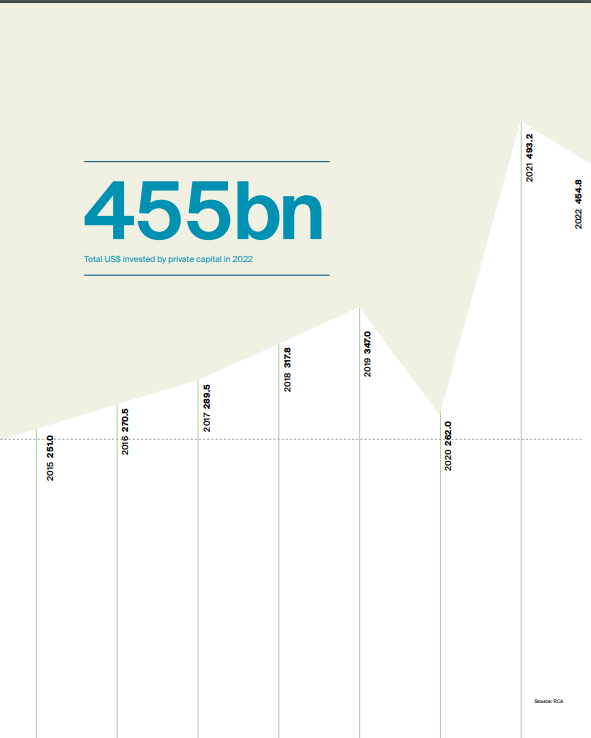

We conducted in-depth conversations with industry experts and surveyed more than 500 private bankers, wealth advisors and family offices as part of our Wealth Report: Outlook 2023 survey. The study provides a unique barometer of investors’ shifting views on near term risks and opportunities and suggests private capital will play an outsized role in real estate markets amid what is likely to be another turbulent year.

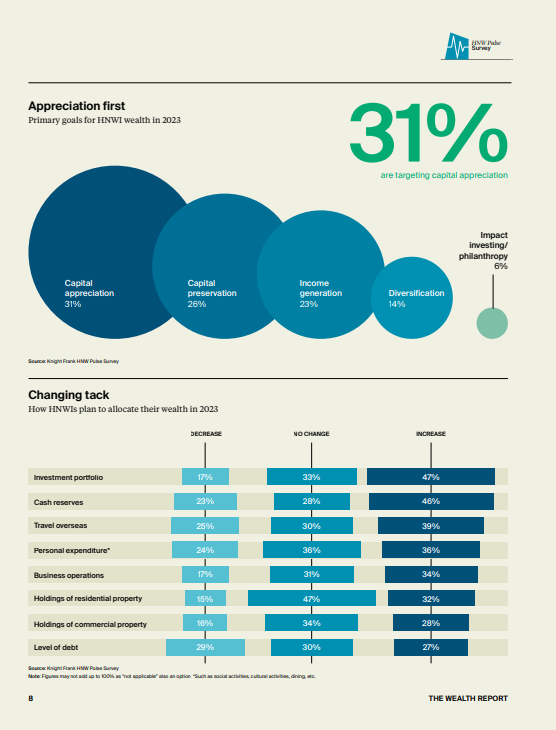

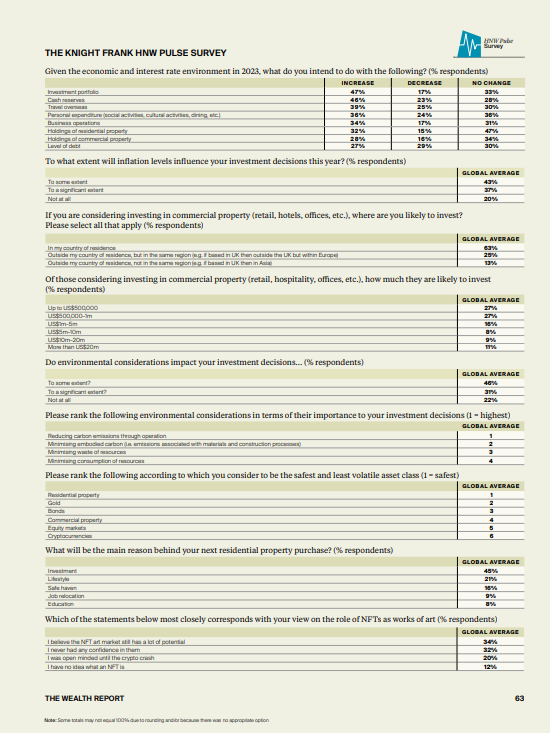

While inflation (cited by 67% survey respondents), interest rates (59%) and geopolitical risks (53%) continue to dominate investor concerns. Real estate (46%), tech (33%) and equity markets (28%) are cited as the leading opportunities in 2023 for wealth creation.

Our Knight Frank colleague Flora Harley, who compiled the study, notes that property’s “attributes as an inflation hedge and portfolio diversifier” help explain its popularity, though attractive values will also act as a draw. Indeed, the pressure caused by higher interest rates has created a window of opportunity for private capital seeking to acquire assets – a particularly appealing prospect amid a looming dearth of best-in-class property in both residential and commercial markets.

That said, bullish investors will have to work hard to uncover opportunities. By most measures equities remain expensive relative to underlying earnings and, with quantitative easing programs being pushed into reverse, the private sector will be expected to absorb elevated levels of bond issuance in the US, EU and the UK this year – depressing prices and raising yields.

Similarly, property values have been under pressure for several months as investors recalibrate their views on pricing in the light of higher interest rates, but there remains limited evidence of the levels of distress required to push values down to very attractive levels.

The latest RICS Global Commercial Property Monitor, for example, suggests industry sentiment, though falling, remains well above the lows of the Covid period. Views on values over the next twelve months are also negative, but only modestly. About half of global respondents to the RICS survey believe values still look expensive. The metric falls to four in ten in the UK.

That paints a picture of a sector under pressure but showing resilience. While we do expect a substantial shift in portfolio strategy among investors as they increasingly seek out value opportunities, those seeking distress may be disappointed. Rather, our expert interviewees suggest those taking the longer view will be rewarded. Kunal Lakhani of NAB summarized conditions neatly to us when he said that 2022 “provided a shift from a high growth mindset to more traditional methodologies around value and quality of business management…now, with the higher-rate environment, there is likely to be a longer-term approach and less looking for quick gains.”

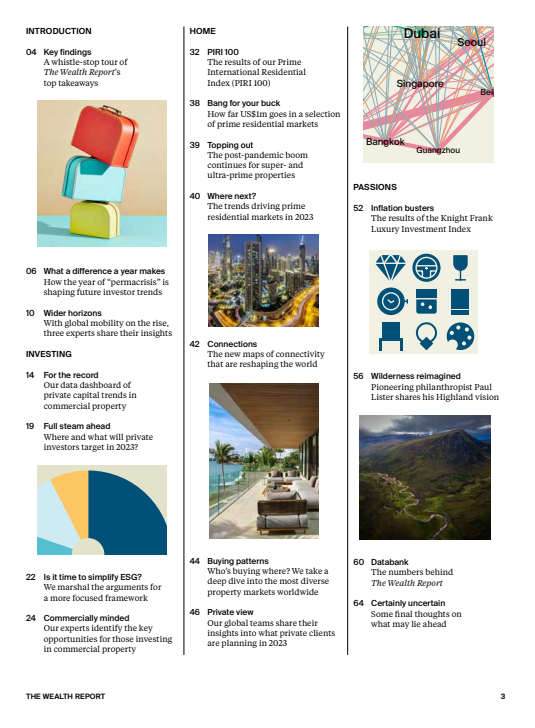

Ten themes for 2023

Key takeaways from The Wealth Report: Outlook 2023: –

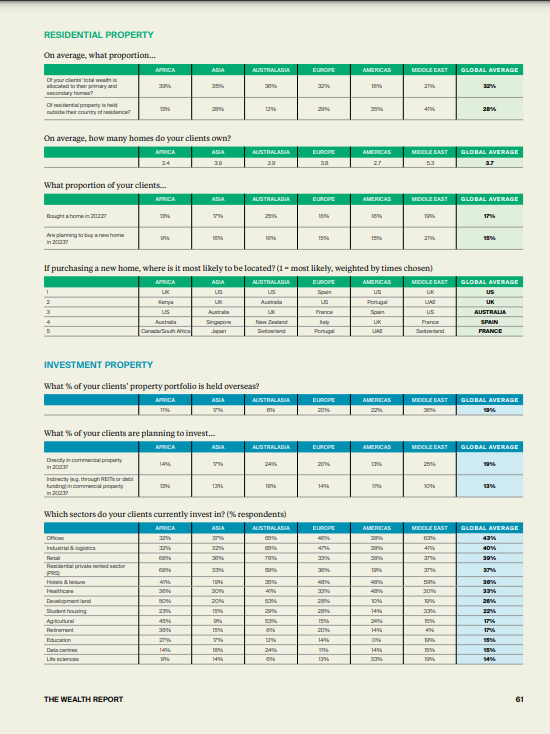

- Global movement has been tempered by the pandemic, but the desire to be mobile is proving resilient. Some 13% of UHNWIs are planning to apply for a second passport or new citizenship, down only slightly from the 15% recorded in our 2022 report.

- Globally, a third of total wealth is allocated to UHNWI’s primary and secondary homes, of this allocation more than a quarter is held outside their country of residence. UHNWIs in the Middle East have the highest global footprint (41%).

- The average UHNWI owns 4.2 homes globally.

- Higher interest rates will temper demand for residential property in 2023. Some 15% of UHNWIs are looking to purchase a residential property this yeardown from 21% in the previous year’s survey. Appetite is highest amongst Middle Eastern UHNWIs.

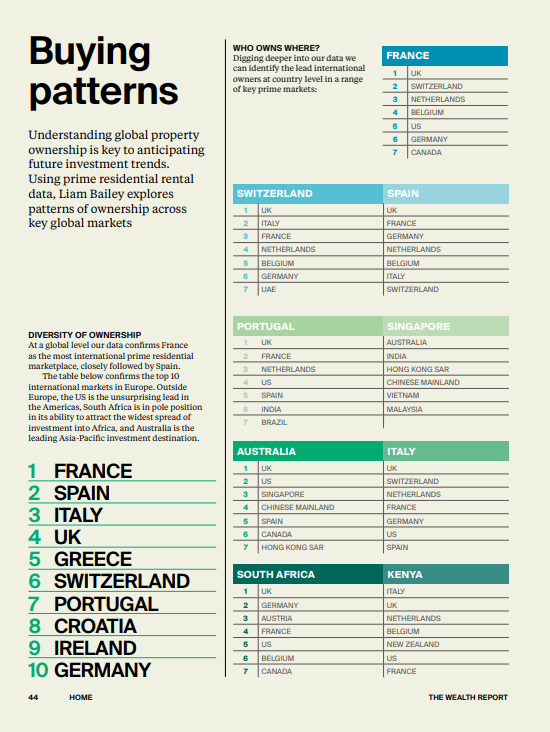

- The US, UK and Spain are the top three locations for purchasing homes. Australia and France round out the top five.

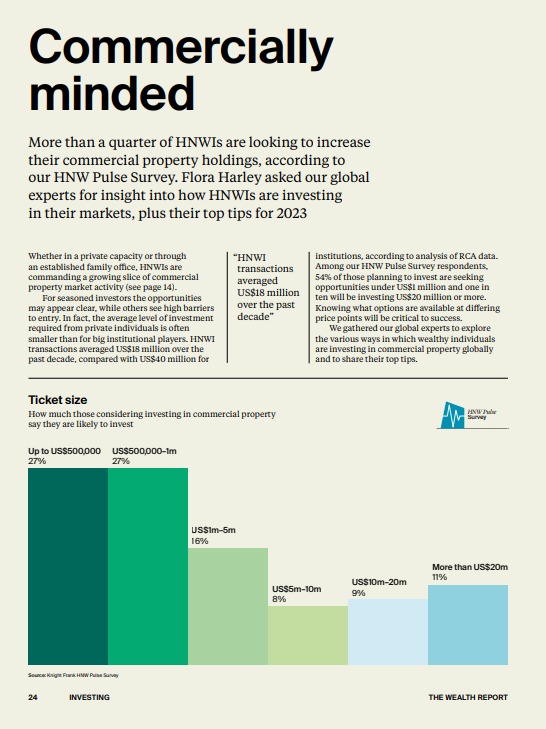

- UHNWIs are increasingly diverse both by geography and asset class. More than a fifth of respondents’ investable wealth is directly invested in commercial property with a similar proportion held overseas.

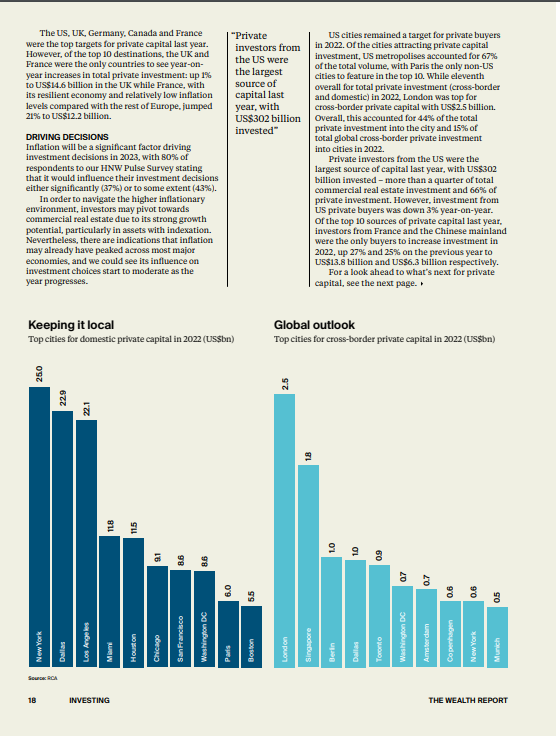

- Real estate was identified as a top opportunity, both for direct and indirect investment. One in five UHNWIs are planning to invest directly in 2023, with 13% looking for indirect opportunities.

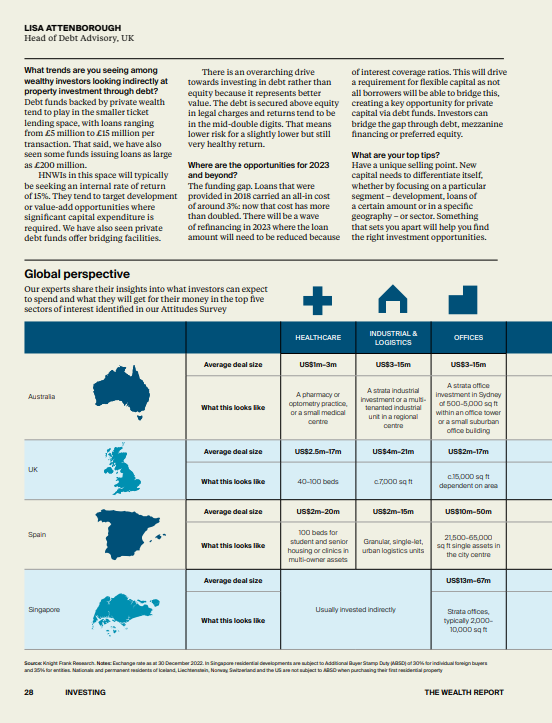

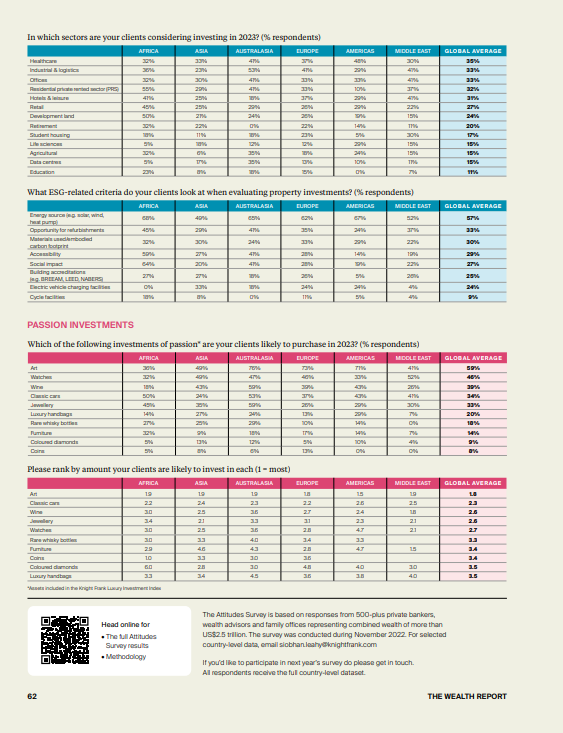

- Healthcare, logistics/industrial and offices are the top target sectors for UHNWIs in 2023. The private rented residential sector and hotels/leisure complete the top five. Around a third of respondents are interested in each of the top five sectors in 2023.

- Energy source (57%), opportunity for refurbishments (33%) and materials used/the embodied carbon footprint (30%)are increasingly being looked at by UHNWIs when purchasing investment property.

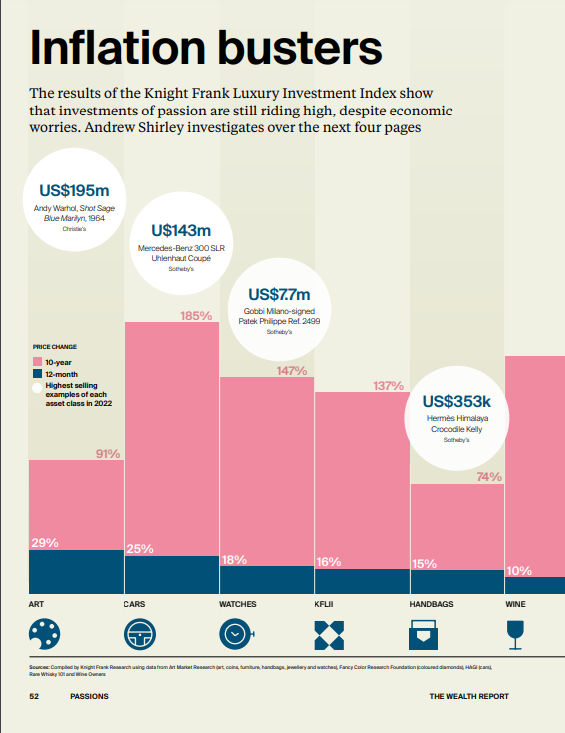

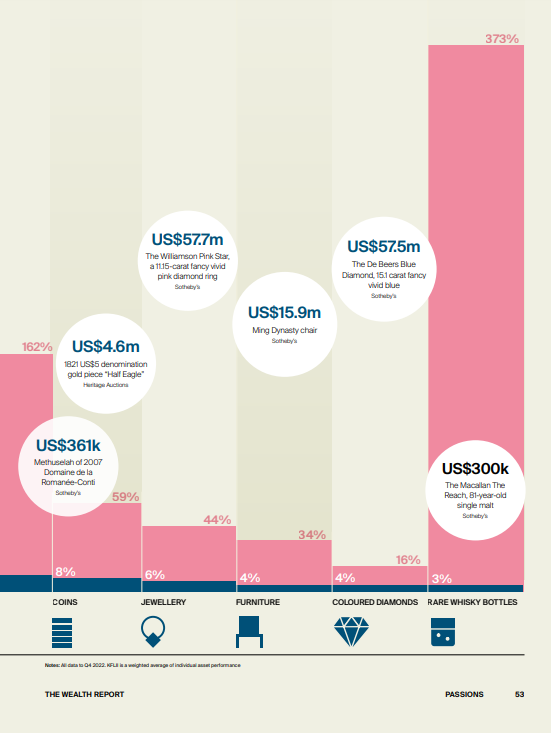

- Art is set to remain the most sought-after investment of passion in 2023 with 59% of UHNWIs likely to make a purchase this year. Watches come in second, with 46% looking to purchase, followed by wine with 39%. In terms of how much they will spend – art is again at the top, followed by classic cars and wine.

Access the full findings here.

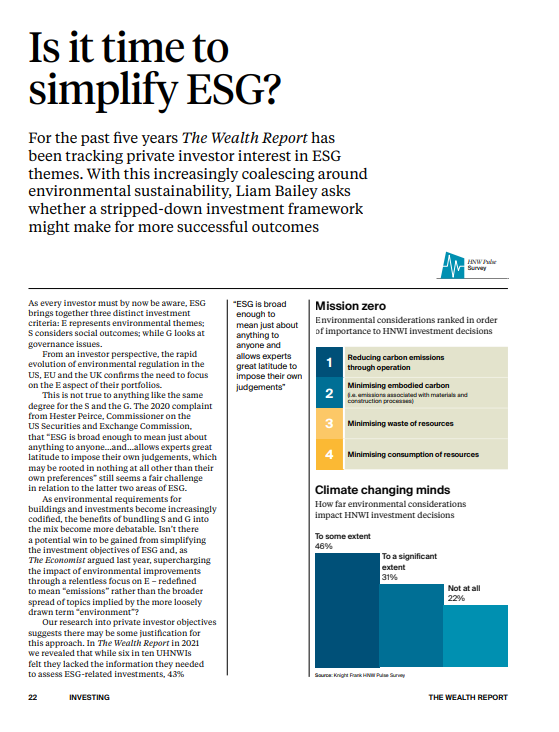

Challenges for ESG

Equities with strong ESG characteristics underperformed during 2022, ramping up pressure on asset managers favoring ESG-led funds to justify their approach. The MSCI World index, for example, was down 14% in December, while its ESG comparable lost 15%, though the results have looked particularly bad next to oil and gas for two years running as a result of the energy crisis.

Sections of the US Republican Party have made ESG a key issue, accusing some firms of putting political issues over their fiduciary duties, this has prompted strong rebuttals: “we focus on sustainability not because we’re environmentalists, but because we are capitalists and fiduciaries to our clients,” Blackrock chief executive Larry Fink said in his 2022 letter to CEOs.

Over the longer term that may prove to be the case, and money continues to flow rapidly into sectors like clean energy, which has outperformed, but the debate is likely to rise to the fore again this year. As the FT notes, Republicans in Congress will likely pick up the attack now that they control the House of Representatives. The probability of regulation over financial sector ESG claims is rising, which may be no bad thing for defenders of the concept.

Singapore – the wealth hub

We’ve been tracking Singapore’s growing status as a regional wealth hub – see this piece in the Wealth Report 2022. Numbers of single-family offices have jumped nearly threefold since the pandemic began. The influx of wealthy individuals is being felt from the property market to the golf course. Bloomberg reports that the cost for an expatriate to join the 36-hole Sentosa Golf Club overlooking the Singapore Strait has more than doubled since the end of 2019 to S$840,000 ($618,000). For citizens and permanent residents, the membership price has surged to as much as S$500,000.

All of this is putting pressure on the prime property market. A total of 296 luxury non-landed homes were sold in 2022, substantially lower than the 487 transactions recorded last year. Our team report that the lack of family-sized units for sale is the cause of the decline. Many want to avoid selling before they secure a home. Prices continued to rise, increasing 5.7% y-o-y from S$2,360 psf in H2 2021 to S$2,495 psf in H2 2022.